about claims settlement

Understanding claims settlements

Claims settlements show which costs for medical treatment are covered by Sanitas.

Items on the claims settlement

Claims settlements show which costs Sanitas pays and your share of the costs. We therefore welcome customer feedback on claims settlement documents. If you have any questions, for example on a charged item, copayment or itemised amounts, please get in touch.

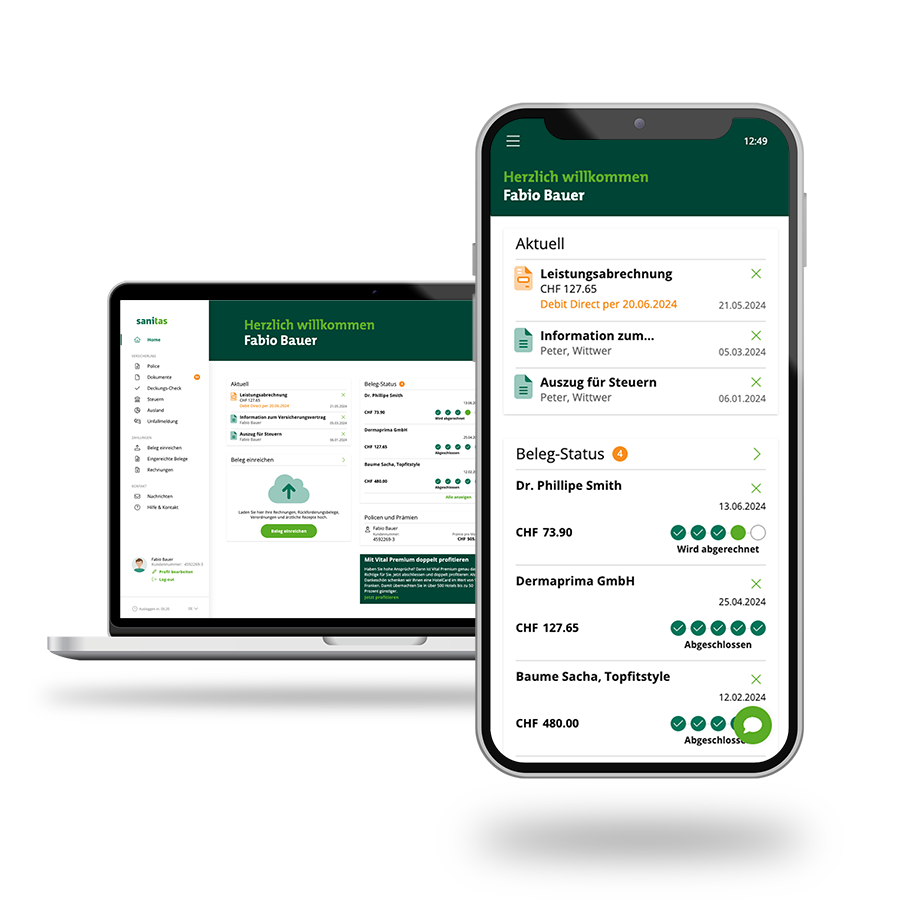

It’s easiest in the Sanitas Portal

The Sanitas Portal allows you to manage your health insurance quickly and easily.

Types of cost reimbursement

There are two ways to pay medical bills. It depends on the type of reimbursement.

-

You pay the invoice first

Cost reimbursement (Tiers garant third-party guarantor):

01

You receive an invoice

The doctor, therapist or hospital sends you the invoice directly with a reclaim voucher.

02

You pay the invoice

You have to pay this invoice.

03

You send us the reclaim voucher

You then send the reclaim voucher to Sanitas.

04

We reimburse the amount

We will check the invoice and refund you the appropriate amount in line with your insurance cover and minus your cost share.

-

Sanitas pays the invoice at first

Direct payment (Tiers payant third-party payer):

01

We receive the invoice

The doctor, therapist or hospital sends us the invoice for your treatment.

02

We pay the invoice

If a direct payment has been contractually agreed with them, we will pay the invoice.

03

You receive an invoice from us

We then send you an invoice for you to pay your cost share. You will also be billed for uninsured benefits.

You don’t understand terms like deductible, VVG and Tarmed? No problem.

What is the cost share?

In Switzerland, insured persons are obliged by law to pay a share of their treatment costs.

The cost share comprises the deductible, copayment and hospital contribution. The year in which the treatment took place is used to calculate the costs. The date of invoicing or payment of the invoice is irrelevant.

-

Deductible

The deductible is the fixed amount that insureds pay annually towards the cost of their treatment. As soon as the medical costs exceed your chosen deductible, we contribute towards any further costs. The legal minimum deductible for insured persons aged 18 and over is CHF 300 per calendar year. You can increase your deductible to up to CHF 2,500 on a voluntary basis. If you choose a higher deductible, we reward you with a discount on the premium.

-

Children under age 18

There is no legally predefined annual deductible for children under age 18. Parents simply have to cover the copayment. However, to reduce premiums it is possible to choose a voluntary deductible for children.

-

Copayment

The copayment is the percentage share that you pay towards your treatment costs. Once the deductible is exhausted, we pay 90% of the treatment costs, with the insured covering the remaining 10%. For adults, the maximum copayment is CHF 700 per calendar year; for children under 18 it is CHF 350. The copayment for medicines can be up to 40%.

-

Hospital contribution

Inpatient hospitalisation involves not only treatment costs but also the cost of accommodation and board. All insureds aged 26 and over have to pay a hospital contribution of CHF 15 per day for the latter. Children and young adults up to the age of 26 who are still in education don’t pay a hospital contribution.

-

Special cases: maternity, prevention, accident

- Maternity: For expectant mothers from the 13th week of pregnancy up to 8 weeks after the birth, no deductible, copayment or hospital contribution is applied.

- Prevention: The deductible is waived for same preventive check-ups if they are provided as part of a national or cantonal preventative health programme.

- Accident: If you have accident insurance through your employer, accident insurance covers the treatment costs and no cost share applies. If accident cover is provided through your health insurer (e.g. self-employed, retirees or people not in gainful employment), you pay a share of the costs via the deductible, copayment and hospital contribution.

In the event of accidents caused by third parties (third-party liability accident), you can reclaim your share of the costs from the liability insurance of the person responsible.

Any questions? We'll be glad to help.

Here’s something else you may be interested in

1 / 3

1 / 3